The Ultimate Guide To Home Improvement News

Wiki Article

Home Improvement News - Questions

Table of ContentsFascination About Home Improvement NewsHome Improvement News - Truths3 Simple Techniques For Home Improvement NewsSee This Report on Home Improvement News

So, by making your residence a lot more secure, you can in fact earn a profit. The inside of your residence can get obsoleted if you don't make adjustments and upgrade it every when in a while. Inside style styles are always changing and what was stylish 5 years earlier might look ludicrous today.You could also feel bored after checking out the exact same setup for many years, so some low-budget modifications are always welcome to offer you a little bit of adjustment. You choose to incorporate some classic aspects that will proceed to seem current and elegant throughout time. Do not worry that these renovations will be expensive.

Pro, Idea Takeaway: If you really feel that your house is also tiny, you can remodel your cellar to increase the amount of room. You can use this as an extra room for your family members or you can rent it bent on generate additional revenue. You can take advantage of it by working with specialists who supply remodeling solutions.

Getting My Home Improvement News To Work

Residence remodellings can enhance the method your home looks, but the benefits are a lot more than that. Check out on to discover the advantages of home remodellings.

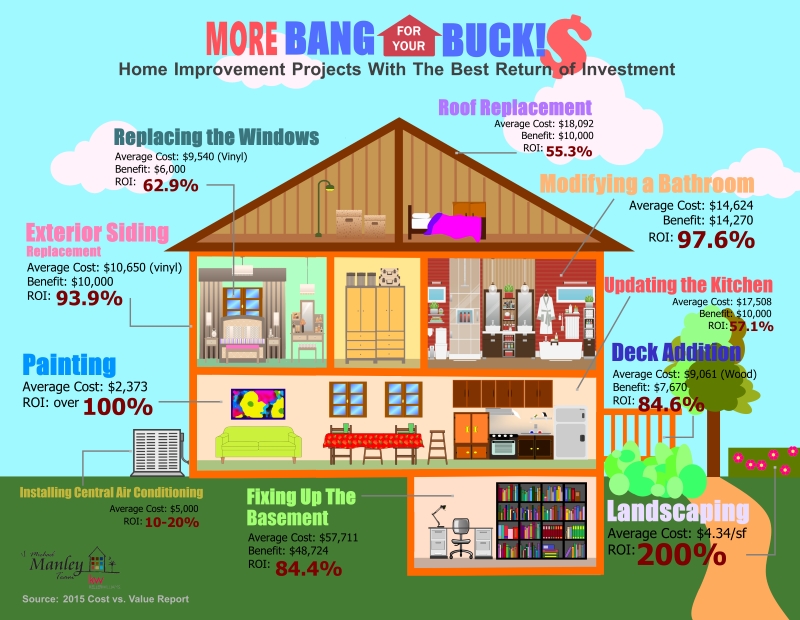

Not only will it look out-of-date, but areas of your house and critical systems can start to show wear. Normal home maintenance and also fixings are necessary to keep your property worth. A house remodelling can assist you keep as well as enhance that value. Tasks like outside improvements, cooking area improvements, as well as restroom remodels all have outstanding rois.

Residence equity loans are popular amongst house owners wanting to money restorations at a reduced rates of interest than various other financing choices. One of the most common usages for home equity. https://dribbble.com/hom3imprvmnt/about financing are residence enhancement tasks as well as financial obligation consolidation. Making use of a home equity loan to make home renovations includes a couple of benefits that various other usages don't.

The Definitive Guide to Home Improvement News

That set rate of interest price indicates your monthly repayment will certainly correspond over the term of your car loan. In an increasing rate of interest atmosphere, it might be less complicated to factor a fixed repayment into your spending plan. The other choice when it involves touching your home's equity is a house equity line of credit, or HELOC.You'll just pay rate of interest on the cash money you've borrowed throughout the draw period, however, normally at a variable price. That indicates your monthly payment goes through alter as rates rise. Both house equity car loans as well as HELOCs use your home as collateral to secure the finance. If you can't afford your regular monthly repayments, you might shed your residence-- this is the largest threat when obtaining with either sort of financing.

Take into consideration not just what you desire today, but what will certainly attract future buyers since the projects you pick will certainly affect the resale value of your residence. Job with an accounting professional to ensure your interest is correctly subtracted from your taxes, as it can conserve you 10s of hundreds of bucks over the life of the loan (power washing).

The 5-Minute Rule for Home Improvement News

Home equity fundings have reduced rates of interest compared to various other sorts of lendings such as individual fundings and also credit report cards. Existing home equity rates are as high as 8. 00%, yet personal fundings go to 10. 81%, according to CNET's sister site Bankrate. With a house equity car loan, your passion price will be repaired, so you don't have to stress over it going up in a rising rate of interest rate environment, such as the one we remain in today.As stated over, it matters what kind of improvement tasks you embark on, as specific residence renovations use a greater return on financial investment than others. A minor cooking area remodel will certainly recover 86% of its value when you market a residence compared with 52% for a wood deck addition, according to 2023 information from Remodeling magazine that assesses the expense of redesigning projects.

While property worths have actually escalated over the last two years, if house prices go down for any type of reason in your area, your financial investment in enhancements won't have actually raised your house's value. When you end up owing a lot more on your home loan than what your house is actually worth, it's called adverse equity or being "underwater" on your mortgage.

A HELOC is typically better when you desire a lot more flexibility with your funding. With a fixed-interest rate you don't require to fret about your settlements increasing or paying extra in rate of interest in time. Your monthly repayment will constantly coincide, whatever's occurring in the economy. Every one of the cash from the lending is dispersed to you upfront in one repayment, so you have accessibility to all of your funds immediately.

Report this wiki page